Weighted overtime calculator

The following examples provide guidance on how to calculate overtime for employees who receive shift differential pay. Unless specifically exempted employees covered by the Act must receive overtime pay for hours worked in excess of 40 in a workweek at a rate not less than time and one-half their regular.

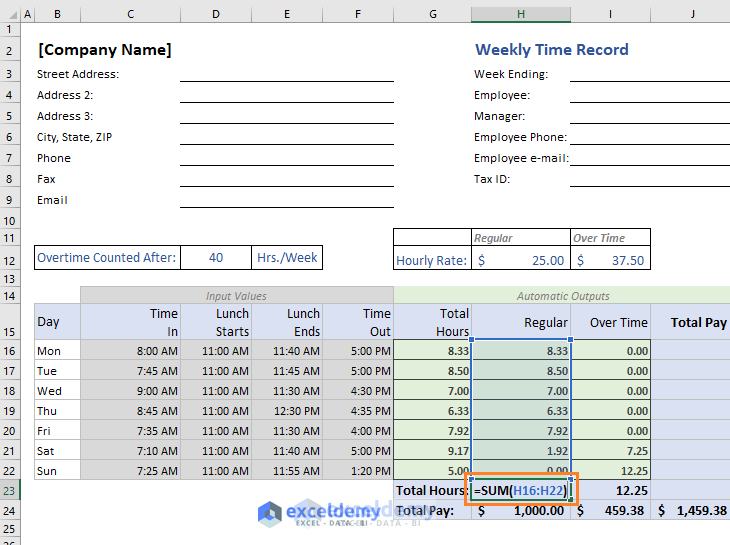

Free Time Card Calculator For Excel Excel Progress Report Template Templates

In the situation of an employee who works two different jobs at two different rates of pay the FLSA.

. In the Exclusions section mark the Weighted average overtime calculation checkbox. Overtime pay per year. C B PAPR.

A workweek is a fixed and regularly recurring period of 168 hours or seven consecutive 24-hour periods. The weighted average regular rate of pay for this employee would equal 40 X 15 10 X 13 50 1460 per hour regular rate. Overtime Security Advisor helps determine which employees are exempt from the FLSA minimum wage and overtime pay requirements under the Part 541 overtime regulations.

It may begin on any day of the week and at any hour of the day. Blended OT 975 x 05 4875 round. Contents Index Top 10 Tips Disclaimer.

The weighted average x is equal to the sum of the product of the weight w i times the data number x i divided by the sum of the. Overtime refers to the time worked by an employee over 40 hours per week. Average calculator Weighted average calculation.

The algorithm behind this overtime calculator is based on these formulas. The Weighted Average Overtime Rate Blended OT is calculated using the following formula. Regular Rate Overtime Multiplier Overtime Rate.

Employees Working at Two or More Rates. Click the Enter button to save the change. To use weighted averages for calculating.

B A OVWK. Single Shift Differential. A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a half.

A RHPR OVTM. 1200 40 hours 30 regular rate of pay. Overtime pay is often more than the regular hourly rate too.

According to The Fair Labor Standards Act FLSA most employees must be paid 15 times. Example of WAOT when. The employees total pay due including the overtime premium for the workweek can be calculated as follows.

Setting up a shift-premium employee to use the WAOT calculation. Thus using this calculation method the employee would be. WinTeam uses the weighted average pay rate to calculate the extra 50 owed or in the case of double-time to calculate the extra 100 owed.

30 x 15 45 overtime. In some situations an employer may want to include the dollar amount associated. Weighted Average Overtime WAOT is a calculation method used in situations in which an employee works two different jobs at two different rates of pay.

Overtime pay per period.

Excel Formula To Calculate Hours Worked Overtime With Template

Elaws Flsa Overtime Calculator Advisor

Weighted Average Overtime Calculation Overview

Pin On Building Muscle

Overtime Calculator

How To Calculate Blended Overtime For Dual Pay Rates Wrapbook

Overtime Calculator

Excel Formula To Calculate Hours Worked Overtime With Template

Pin By Jessica Shearer Heihn On I Like That Stay At Home Mom Stay At Home Mommy Life

Excel Formula Timesheet Overtime Calculation Formula Exceljet

How To Calculate Overtime Pay For Hourly And Salaried Employees Article

Weighted Average Overtime Waot Calculation

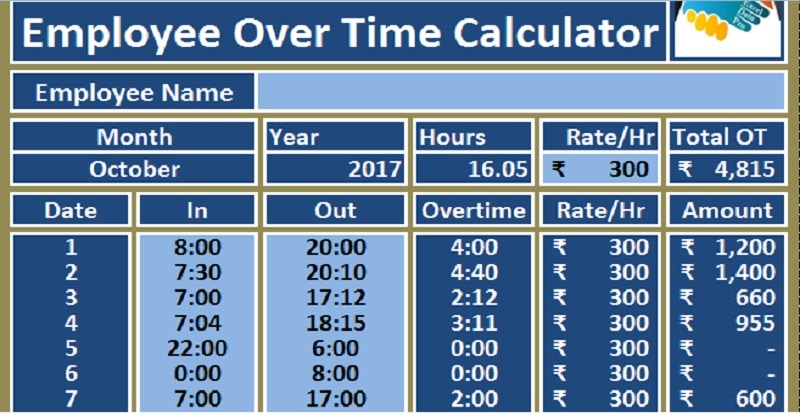

Download Employee Overtime Calculator Excel Template Exceldatapro

Download Employee Overtime Calculator Excel Template Exceldatapro

Real Estate Commission Calculator Templates 8 Free Docs Xlsx Pdf Real Estate Training Real Estate Templates

Estimate The Debt Service Coverage Ratio With The Dscr Calculator Http Www Thecalculator Co Finance Dscr Calculato Debt Service Calculator Cost Of Capital

Overtime Calculator To Calculate Time And A Half Rate And More